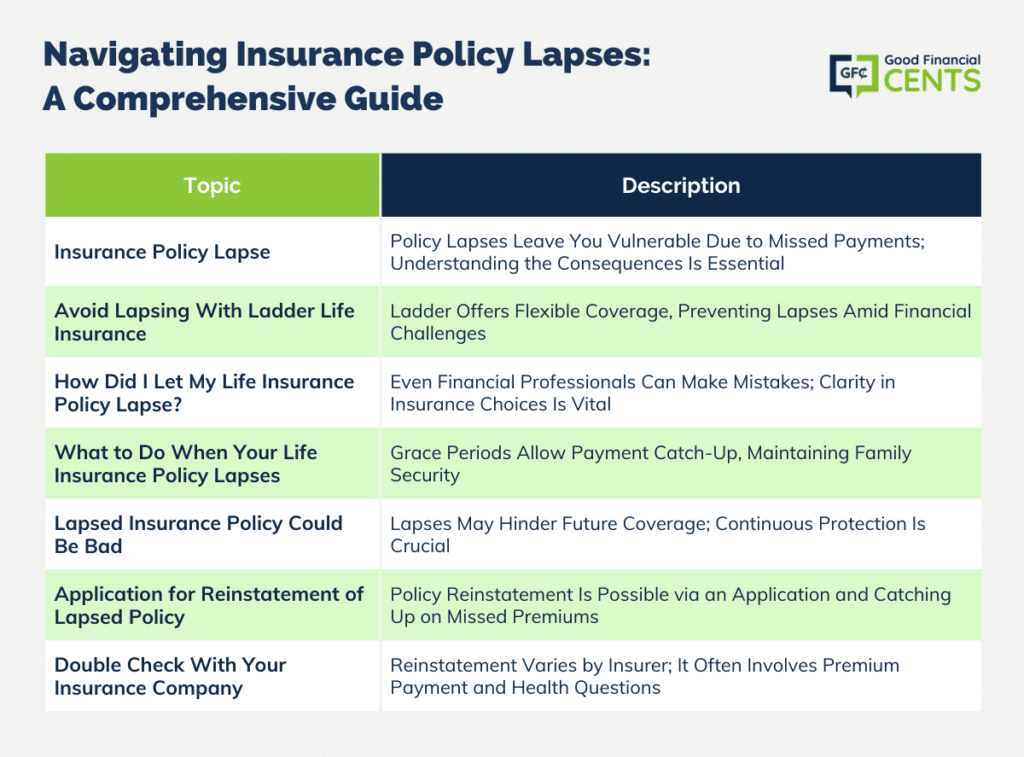

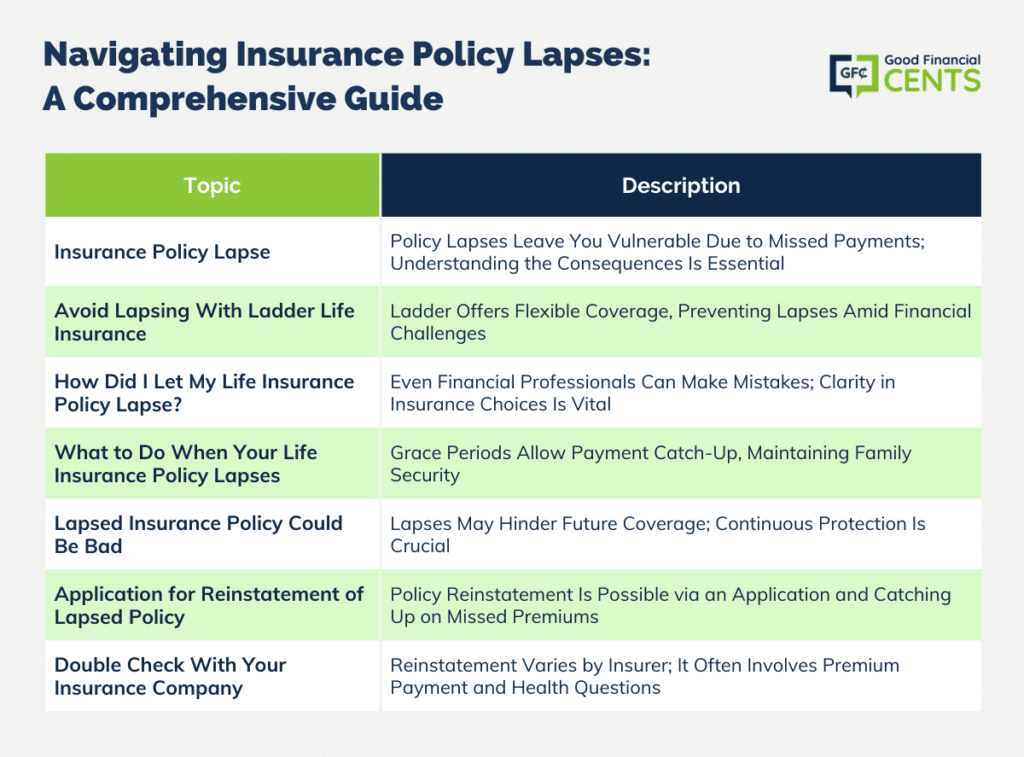

Discover what happens when your life insurance policy lapses and how to navigate the situation effectively. Learn about grace periods, reinstatement options, and the importance of maintaining active policies to avoid potential setbacks and higher premiums.

Jeff Rose, CFP® Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance. Read More

The GFC® Money Expert Review Board The GFC® Money Expert Review Board is a team of financial experts who provide independent, unbiased reviews of financial products. Read More

Advertising Disclosure GoodFinancialCents® has an advertising relationship with the companies included on this page. All of our content is based on objective analysis, and the opinions are our own. For more information, please check out our full disclaimer and complete list of partners.

Quality VerifiedGoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Why You Can Trust GoodFinancialCents®GoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

We all get busy and let the “little things” slip through the cracks sometimes.

This, however, wasn’t a little thing. In the hustle and bustle of the holidays, building a new home, a second child on the way (and now here) a “little” bill was overlooked and wasn’t paid.

This wasn’t my Direct TV bill or the electricity bill… It was my annual premium for my 30-year term life insurance policy! (gasp).

A month had passed before I realized that my insurance policy had lapsed. Frantically, I called the insurance company to find out what my options were.

In case you ever let any different types of life insurance policy lapse, here’s what you need to know.

A payment slipping through the cracks is one reason your policy might lapse, but it isn’t the only one.

Sometimes individuals run into unexpected hits like job loss or the expense of caring for a sick loved one and find themselves unable to afford the policy premiums they originally agreed to.

Enter the dynamic life insurance policy. With a life insurance company like Ladder, there’s no need to default on payments.

If you find your policy is too much to bear, or conversely, you need more in force, you can adjust your life insurance policy to meet your changing needs.

Laddering down your coverage, as the company refers to it, can help make your premiums more manageable and keep your policy in force whatever life brings your way.

I know what you’re thinking. He’s a CERTIFIED FINANCIAL PLANNER™ professional and he let his life insurance policy lapse?

Right now I have 3 separate term life policies. When my wife and I first got married we purchased a $250k 30-year term life policy on myself.

After we had our first child, I decided to purchase another 30-term life policy for $500k. After we just built our new house and had a second child, I decided to stop messing around and purchased a $1 million term policy.

My initial intention was to let the $250k lapse, although I later decided to just keep them all. I told my wife of my intent, but she thought that I meant to let the $500k policy lapse. Whoops!

So, your policy has lapsed, now what do you do?

When I called the insurance company, I learned through the recording that they have a grace period. When you pay your premiums regularly, your policy remains “in force,” but when you miss a payment, your life insurance company is required to give you a 31-day “grace period” in which to catch up.

At the end of the grace period, if you haven’t submitted your back premiums to the life insurance company, your policy will lapse.

This is basically what happened to me. I was fortunate to be in a financial position where there wasn’t a real problem letting the policy lapse. I had plenty of other coverage to take care of my wife and kids.

Even if I had to go through the medical exam again, I know that I would still have received a preferred rate because of my excellent health. (Working out and eating healthy pays off!) Don’t let my luck fool you. Be sure to stay on top of your life insurance policies.

Many of the top-rated insurance companies, when offering life insurance coverage to an individual, don’t check to see if the individual has had coverage before, or if that coverage has lapsed.

Some life insurance companies do check to see if you’ve had coverage lapses in the past.

If you have, they may choose not to offer coverage to you in the future, which means you’ll have a very hard time finding the protection you and your family need, even if you’re able to better afford it than you were in the past.

When your policy lapses, I learned that it isn’t necessarily the end of the world for your life insurance protection. I was informed that you can request an application for reinstatement.

(You can see the picture of the application above). I simply had to answer a few health-related questions and enclose the check for the missed premium amount.

Each life insurance company handles the reinstatement process differently, but in general, you’ll be asked to pay all of your back premiums, and you’ll only have about five years within which to request a reinstatement. As long as your health status hasn’t changed, reinstatement can be very simple.

If your health has changed, however, it may not be possible to have your old policy reinstated – another reason to be sure that you keep the policies you have in force.

Policyholders must be vigilant in safeguarding their interests. Policy relapse can be a significant setback, especially for those whose health conditions have shifted over time. Reinstating an old policy under such circumstances can prove challenging, underscoring the imperative of maintaining active policies. The consequences of a lapse could lead to higher premiums, less favorable terms, or even outright denial of coverage.