In April of 2021, Ways and Means Committee Chairman Richard Neal, (D-Mass.), reintroduced the Public Servants Protection and Fairness Act of 2021 . This legislation was originally presented to Congress in 2019, but died without receiving a vote. But now that the balance of power has shifted in both houses of Congress, this proposal has a much higher likelihood of passage.

The goal of this Act is to provide an equitable Social Security formula for individuals with noncovered employment and to provide relief for individuals currently affected by Social Security’s Windfall Elimination Provision (also known as the WEP).

Repealing the WEP with a new formula should help ease the difficulty that individuals with noncovered pensions face when planning for retirement. Although it’s not widely known, the annual Social Security benefit estimate does not include the WEP penalty in the estimated benefit. Furthermore, most Social Security technicians – let alone financial advisors – fail to understand the nuances of how the WEP is applied. They cannot explain it adequately, and although they may be trying to help, too often only add to the confusion.

T here’s no reason we need to keep going this way. It’s past time for this outdated rule to be reformed.

To better understand the legislation on the table and how it would impact your Social Security benefits, it helps to start with a quick recap of how the WEP works today, what would change, and why reform has been a long time coming.

The WEP rule reduces Social Security benefits for those who worked in a job in which:

Teachers are one of the most common groups to be impacted by this rule, but it often includes other public sector workers like firefighters, police officers, and numerous other state, county, and local employees.

In a press release , Representative Neal explained why he introduced a new piece of legislation to repeal the existing Windfall Elimination Provision:

“Originally, the WEP was intended to equalize the Social Security benefit formula for workers with similar earnings histories, both inside and outside of the Social Security system. However, in practice, it unfairly penalizes many public employees. The much-needed reforms in this bill provide meaningful WEP relief to current retirees and public employees while treating all workers fairly.”

This is certainly not the first serious effort to reform the WEP, but this could have a better chance of success than its predecessors.

In the past, most of the reform bills died a fairly quick death. The topic of WEP repeal or reform makes for good election-year campaign speeches. Once the election is over, however, the bills struggle to get the necessary traction and bipartisan support for passage.

The closest any WEP reform legislation has gotten in the past few years was when Representatives Kevin Brady (R-TX) and Richard Neal (D-MA) co-sponsored the Equal Treatment of Public Servants Act of 2015 (H.R. 711). Ultimately, the House Committee on Ways and Means postponed its consideration of that proposal due to concerns raised by the 175,000-member National Active and Retired Federal Employees Association (also known as NARFE).

While there may still be roadblocks to The Public Servants Protection and Fairness Act of 2021, objections from NARFE won’t be one of them. The group already offered their support of this bill, releasing a statement to say they wanted to “express support for – and thank you for preparing to introduce – the Public Servants Protection and Fairness Act of 2021.”

There are multiple other national, state, and local employee organizations that have also officially backed this round of legislation, as well. But only time will tell if this support helps turn the Public Servants Protection and Fairness Act into actual law.

Before that happens, anyone impacted by the WEP, and therefore, its potential repeal, needs to understand how this potential change could look.

The Public Servants Protection and Fairness Act of 2021 has three main components:

Let’s cover these individually.

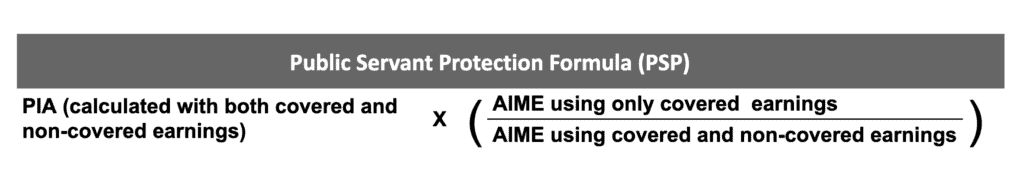

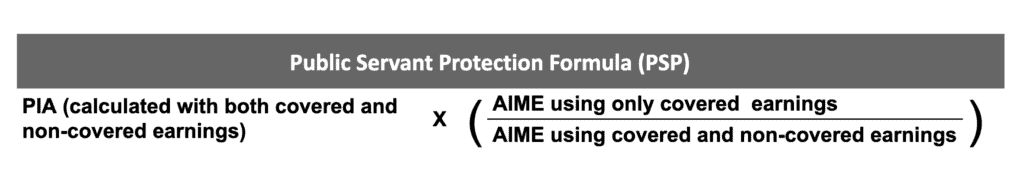

The cornerstone of the Public Servants Protection and Fairness Act of 2021 is the introduction of the Public Servant Protection (PSP) formula. The mechanics of the PSP formula are meant to pay Social Security benefits in proportion to the share of an individual’s earnings that were covered for Social Security purposes.

Here are a few of the most notable features of the proposed PSP formula:

In order to fully understand how the PSP formula will change a benefit calculation, it helps to recap how benefits are currently calculated.

The Social Security Administration currently adjusts your historical covered earnings for the inflation that occurred over your working years. This inflation adjustment goes through age 59; earnings at 60 and beyond are used at face value.

Then, the Administration takes the total of your highest 35 years of covered earnings and divides that by 420 (which is the number of months in 35 years). The result of this calculation is your Average Indexed Monthly Earnings or AIME.

Once your AIME is calculated, the SSA uses its formula to calculate your primary insurance amount, or PIA. This is accomplished by calculating your covered AIME through three separate bands which are in effect in the year you attain age 62:

The sum of these three bands is your PIA or retirement benefit amount at full retirement age (FRA).

The new PSP formula would continue to work off of this same framework, with a few small differences.

First, your PIA would be calculated using both covered and non-covered earnings (instead of only using covered earnings). Then, in addition to calculating your AIME based solely on covered earnings, your AIME would also be calculated using both covered and non-covered earnings.

Using these two AIME calculations would allow the SSA to determine the ratio of covered to non-covered earnings for purposes of awarding Social Security benefits in proportion to the share of an individual’s earnings that were covered.

This entire PSP calculation would be accomplished by a simple two-step process:

An Example of the PSP Formula in Action

We can see how this would work in the real world by walking through an example with real numbers together. Let’s assume your PIA is $2,500. You have an AIME using covered earnings of $4,000, and an AIME using both covered and noncovered earnings of $6,000.

The ratio between those two AIME numbers is .66. The PSP formula then multiplies the PIA by that ratio. In this case, it would be $2,500 x .66 = $1,650 as your actual benefit amount.

Using the WEP formula, an individual with a $4,000 covered AIME would receive a benefit of $1,359, or $291 less per month with the current rules.

Author’s note: It is not immediately apparent if the new AIME calculation (using both covered and non-covered earnings) would be based upon the high 35 years of earnings or ALL years of earnings. Hopefully, we’ll receive clarification on this in the days ahead.

Current retirees and those eligible for Social Security benefits before 2023 who are affected by the WEP, will receive a benefit increase of $150 per month under the proposed changes.

These additional payments will begin nine months after enactment of the bill and will continue each month for as long as the eligible individuals are receiving Social Security benefits.

Individuals will receive this increased payment as long as their WEP reduction is at least $150. If their WEP reduction is less than $150, the increased payment will equal the amount of reduction.

Currently, Social Security statements do not reflect a benefit reduction due to the WEP . This results in serious retirement planning mistakes by individuals who plan their post-work income based on their estimated benefits in their Social Security statement.

If the Public Servants Protection and Fairness Act of 2021 becomes law, the Social Security Administration will be required to show noncovered as well as covered earnings records, and to use the new PSP formula for calculating the projected benefits for workers likely to be subject to this formula. This will result in much more accurate benefit projections and confidence in retirement planning.

As new reform proposals make their way through the legislative process, I’ll be here to keep you informed and tell you what you need to know.

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision . In this guide, I go over more detail on the WEP and answer questions like:

You CAN simplify the WEP rules and get every dime in benefits you deserve! Simply click here to download today.

In addition, I’d highly encourage you to check out some of the additional resources I’ve created that will deepen your knowledge on the WEP.

Also…if you haven’t already, you should join the 328,000+ subscribers on my YouTube channel ! See you there!

House Ways and Means press release

House Ways and Means Committee section by section summary

An older look at how the new formula would work